Money doesn’t grow on trees.

This adage seems to be as old as dirt but it’s accurate. Most people know that, don’t they? Well, they might not.

While I was perusing the business news headlines, I came across an article about the federal minimum wage going up from $5.85 to $6.55. It’s the second phase of a three-phase increase in the minimum wage as stipulated by a 2007 law. Next year’s increase will put the hourly rate up to $7.25. What struck me was the second sentence in the first paragraph in the piece by AP reporter Christopher S. Rugaber:

WASHINGTON - About 2 million Americans get a raise Thursday as the federal minimum wage rises 70 cents. The bad news: Higher gas and food prices are swallowing it up, and some small businesses will pass the cost of the wage hike to consumers.Small businesses will pass the cost on to the consumers? Well no shit, Sherlock. Where the hell else would it come from?

That’s when I realized that Rugaber was probably stating this piece of information because not everyone realizes that money really doesn’t grow on trees. There are some who most likely think that a business—any business, mind you; not just a large, multinational corporation—has an indefinite amount of cash on hand at all times and that the challenge then becomes a classic management-versus-worker struggle: the owner has the money; the worker needs to get it somehow to have a piece of the pie. Thus, the minimum wage becomes the answer.

There are a few problems with this simple-minded view of economics, though.

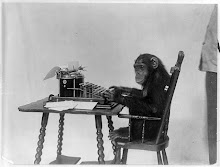

First and foremost, businesses—and especially small businesses—don’t have a bottomless well of money into which they can drop a bucket and just bring up a few thousand dollars whenever they feel like it. Nor do they have a grove of money trees to which they can run and pick a few one hundred dollar bills off whenever cash is getting low. And, unless they want to get busted by the Secret Service for counterfeiting money, they can’t simply print their own money.

A small business gets their money by selling a product or offering a service. Yes, they might start with a sum of money as their initial capital, but that still has to cover costs. Part of those costs is payroll. In order to stay in business, the small business needs a constant flow of income. Hence, the price of the product or service offered has to be adjusted to meet the expenses.

Let’s suppose that I decide to open a small business that makes widgets (a widget being whatever the hell you want it to be). First, I need capital to get the business off the ground. I need money to acquire assets (a building and some widget-making equipment) as well as operational needs (advertising expenses and, for the sake of this example, four employees). Let’s suppose that I got my capital by taking out a small business loan.

Now that my widget company is up-and-running, things are going well. My first year in business is a little rocky, but we survive. In order to continue at a successful rate, though, my expenses (this includes paying my workers and paying off the loan) have to come from somewhere. Where do they come from? The answer is the prices of my goods or services. In my case, it would be the price of my widgets.

I would want my widgets to be priced at a level where it was low enough to compete against any other widget companies, but high enough to pay all my bills.

Let’s suppose that after a few years there’s a slight increase in demand for widgets, and because sales have been good, I’m now able to hire another worker. I’m going to hire him/her at minimum wage while my four original workers are making a few dollars more per hour (they’ve been there longer and would have received a raise or two). The new hire doesn't have the same amount of experience nor does he/she have any seniority.

A few months go by and the new hire’s rate is $5.85 an hour, as stipulated by law. But now I have to increase his/her hourly wage to $6.55. Now I’m faced with two issues:

First, the money is going to have to come from somewhere. I can’t print my own money, and I don’t have any trees that grow it. Thus, I have two choices: (1.) keep my widget prices the same and watch my business bank account begin to drop because I’m paying out more than I’m bringing in, or (2.) raise the price of my widgets to offset the increased payroll expense. Which would you choose?

Second, I’m also faced with the possibility of raising the wages of my four original workers. Unless I’m planning on being an asshole owner, wouldn’t it be fair to give a raise to the other four workers who were with me since day one if I’m giving a raise to a newbie who might still be making a mistake here or there? Yes, the law says that he/she is owed a raise, but if I don’t give the others a raise, too, it’ll cause bad blood between employees—and me.

Well, now I definitely have to make up for those new expenses. Similar to what I mentioned earlier, my choices are to either (1.) continue paying out more than what I'm taking in and go bankrupt, or (2.) raise the price of my widgets to make up for the increased wages. Again, what would you do?

And so, consumers have to be the ones to pay for any increases in wages. It’s not a conspiracy. It’s not greed. It’s basic economics.

But, if you don’t believe any of this and you think that I’m full of shit, just ask yourself this: If raising it isn’t such a big deal, and if consumers shouldn’t have to pay for it, why aren’t the same politicians who are pushing for increasing the minimum wage by a dollar willing to raise it to $10 an hour? Why not $20 an hour? Why not $50 an hour? Wouldn’t that be fair? Wouldn’t that raise the working poor out of poverty?

It wouldn’t and they know it. They know that consumers have to make up for the increase but they also know that too many Americans take everything at face-value, not bothering to consider an action’s reaction. They know that the average American is going to say, “The government is making sure that I’m getting more money, but these greedy small business owners are raising prices now.”

What these same Americans are failing to realize is that those small businesses are employing workers who are just like them, and those employees’ paychecks need to come from somewhere, too. They come from the prices of goods and services purchased by consumers.

That is, of course, unless they have a grove of money-growing trees in their backyard.

Reference

Rugaber, Christopher S. “Federal Minimum Wage Rises to $6.55 Today.” Yahoo! News. 24 July 2008.Ω

No comments:

Post a Comment